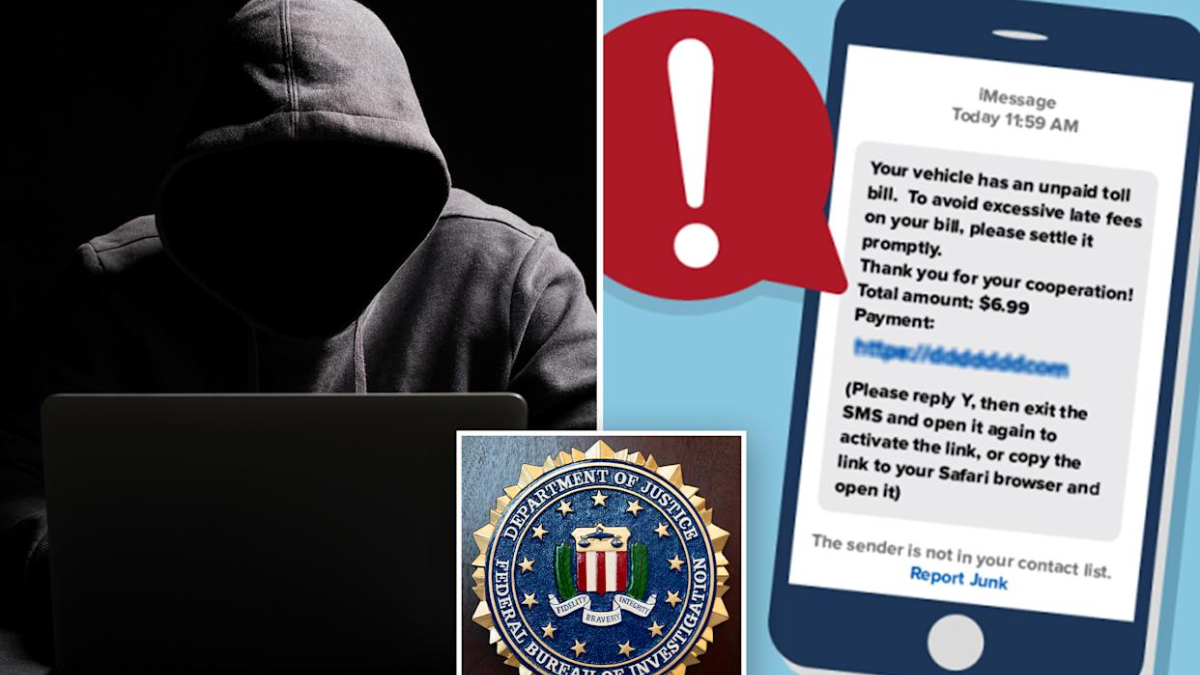

The Federal Bureau of Investigation (FBI) has issued an urgent warning regarding a new wave of texting scams that are targeting individuals across the United States. These scams, often referred to as “smishing” (SMS phishing), involve fraudsters impersonating banks, government agencies, or trusted organizations to steal personal and financial information.

The FBI advises consumers to remain vigilant and take steps to protect themselves from falling victim to these deceptive messages. Here’s what you need to know about the latest scam, how to spot fraudulent texts, and what to do if you receive one.

What Is Smishing?

Smishing is a type of cybercrime where scammers use text messages to trick recipients into sharing sensitive data. These fraudulent messages often claim:

- There is suspicious activity on your bank account.

- Your credit or debit card has been frozen.

- You have an overdue bill or unpaid fine.

- You have won a prize or lottery.

- Your package delivery requires urgent confirmation.

The message typically contains a malicious link that redirects victims to a fake website, prompting them to enter login credentials, Social Security numbers, or banking details.

How the Texting Scam Works

- A Fake Alert Arrives – Victims receive a convincing text message from what appears to be a legitimate source (bank, credit card company, or government agency).

- Urgent Call to Action – The message creates panic or urgency, warning about fraudulent activity or an account suspension.

- Phony Website or Phone Number – Victims are directed to a spoofed website or fake customer service number that appears authentic.

- Information Theft – Once victims enter their passwords, PINs, or personal information, scammers gain access to their financial accounts.

- Unauthorized Transactions – Criminals may drain bank accounts, make fraudulent purchases, or steal identities for further scams.

FBI’s Official Warning

The FBI and Federal Trade Commission (FTC) have both reported a rise in smishing cases, warning that criminals are using advanced technology to make scam messages appear more convincing and sophisticated.

Key FBI Recommendations:

- Do not click on suspicious links in text messages.

- Verify messages by contacting your bank or service provider directly.

- Enable multi-factor authentication (MFA) for extra security on financial accounts.

- Report scams to the FBI’s Internet Crime Complaint Center (IC3) at www.ic3.gov.

Recent Examples of Smishing Attacks

Bank Fraud Alert Scam

A growing trend involves scammers posing as major banks (Chase, Wells Fargo, Bank of America) and sending texts that claim:

“We’ve detected suspicious activity on your account. Click here to verify your identity.”

Once the victim clicks the link, they are redirected to a fake banking login page, allowing fraudsters to steal credentials.

Delivery Notification Scam

Scammers impersonate FedEx, USPS, or UPS and send texts like:

“Your package delivery is on hold. Confirm your details here to proceed.”

These messages lead to fake websites that request credit card details for supposed “delivery fees.”

Government Agency Scam

Fraudsters also impersonate agencies like the IRS or Social Security Administration (SSA) and claim:

“Your Social Security number has been compromised. Call this number immediately to prevent account suspension.”

These scams trick victims into providing their SSN, date of birth, and banking details, which can be used for identity theft.

How to Spot a Scam Text Message

The FBI advises consumers to watch for these red flags:

What to Do If You Receive a Suspicious Text

- Do Not Click Links or Reply – Even replying with “STOP” confirms your number is active, inviting more scams.

- Verify the Sender – Contact your bank, service provider, or agency directly using official phone numbers.

- Block and Report the Number – Use your phone’s spam-blocking feature and report scam texts to 7726 (SPAM).

- Monitor Your Accounts – If you accidentally shared information, change your passwords immediately and monitor accounts for unauthorized transactions.

- Report the Scam – File complaints with the FBI’s IC3 (www.ic3.gov), FTC (www.ftc.gov), and your mobile carrier.

How to Protect Yourself from Smishing Attacks

To reduce the risk of falling victim to texting scams, the FBI recommends the following security measures:

Conclusion

The FBI’s latest warning about smishing scams highlights the growing threat of cyber fraud in the U.S. As scammers continue to evolve their tactics, it is crucial to stay informed and take proactive steps to protect your personal and financial data.

By recognizing red flags, reporting suspicious messages, and using security measures like 2FA and call verification apps, you can reduce your risk of falling victim to these dangerous scams.

Disclaimer – Our team has carefully fact-checked this article to make sure it’s accurate and free from any misinformation. We’re dedicated to keeping our content honest and reliable for our readers.